Electricity Bill 3C

Overview

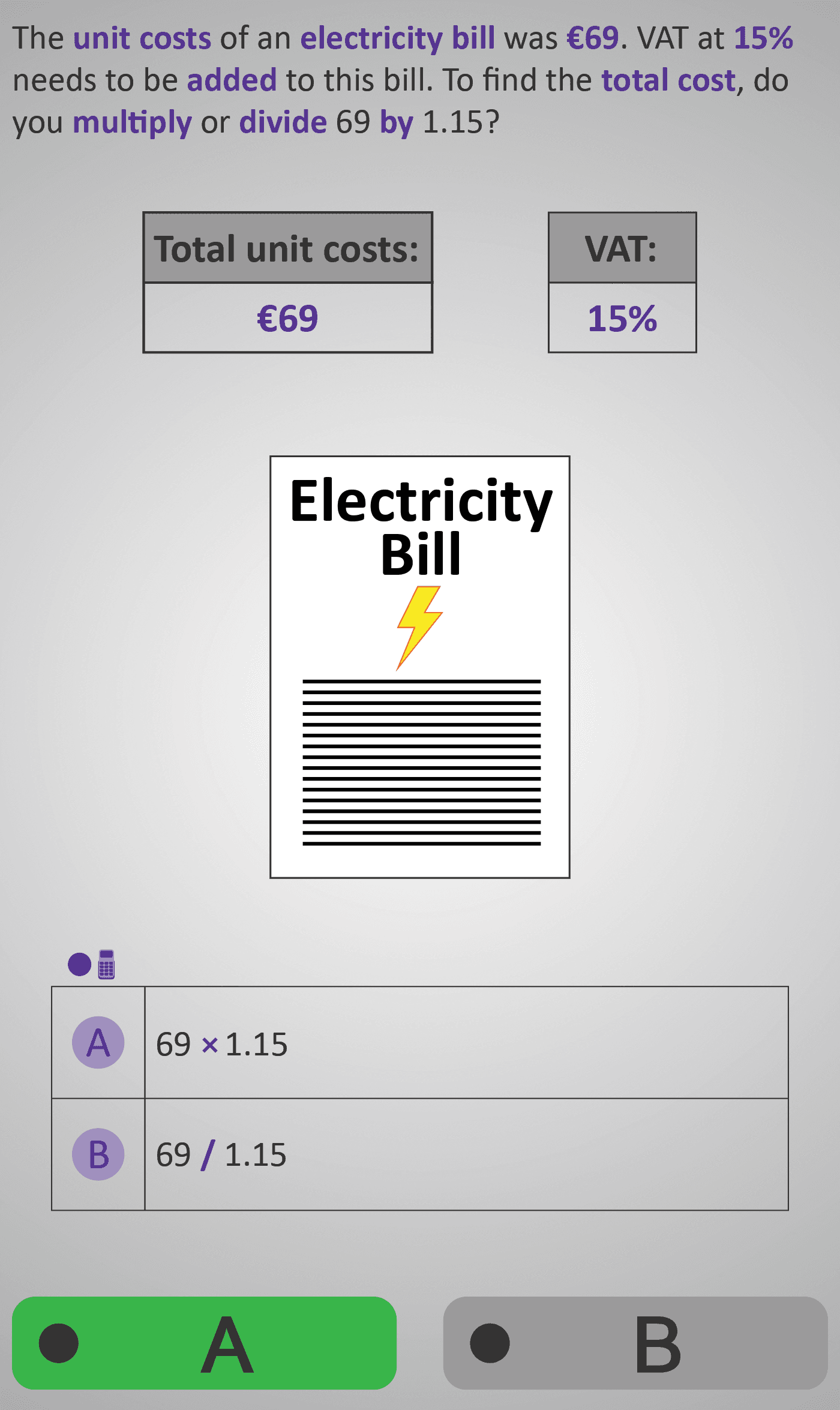

In this real-world Phlow, learners apply percentage and decimal operations to calculate final electricity costs including VAT. The example begins with a known bill total (e.g. €69) and a VAT rate (e.g. 15%). Instead of calculating 15% separately and then adding it on, students discover that multiplying the total by 1.15 includes VAT in a single step.

The Phlow presents several realistic examples such as:

€69 × 1.15 = €73.35

€50 × 1.21 = €60.50

This sequence reinforces the relationship between percentages and decimal multipliers, showing that 1 + VAT rate (in decimal form) gives the total cost including VAT. Visual cues — like the bill icon, calculator display, and side-by-side “unit cost” and “VAT” tables — help link the mathematics to real billing contexts.

By the end, students can confidently calculate VAT-inclusive totals and explain how multiplying by decimals above 1 represents a percentage increase — a key life skill for interpreting receipts, bills, and taxes.

Prerequisite Knowledge Required

- Electricity Bill 3B – Calculating Total Cost from Units.

- Decimals 3C – Multiplying by Decimals.

- Percentages 3A – Converting Between Percentages and Decimals.

- Understanding multiplication by whole numbers and decimals.

- Recognising the meaning of a percentage increase.

- Knowing that 100% + VAT% = total percentage charged.

- Ability to use a calculator for decimal multiplication.

Main Category

Applied Arithmetic / Financial Maths

Estimated Completion Time

Approx. 12–15 seconds per question (4–5 screens total). Total Time: 3–4 minutes.

Cognitive Load / Step Size

Moderate — the concept of multiplying by a decimal greater than 1 builds on prior learning. Each step is scaffolded and visually reinforced, connecting operations to real-life meaning while maintaining focus on one decision per screen.

Language & Literacy Demand

Moderate to High — financial vocabulary such as unit cost, VAT, and total cost enhances numeracy literacy. The combination of text, symbols, and visuals ensures accessibility for diverse learners, linking abstract percentage concepts to concrete contexts.

Clarity & Design

- Two-column tables display “Cost” and “VAT Rate” side by side.

- Purple highlights mark key steps (× 1.15, × 1.21) for clarity.

- Calculator visuals reinforce procedural fluency.

- Currency symbols (€) and decimal alignment support conceptual understanding of money and place value.

Curriculum Alignment

Irish Junior Cycle Mathematics:

- Strand 1 – Number

- Strand 3 – Statistics and Probability (Real-World Applications)

- Learning Outcomes:

- Apply percentage increase calculations using decimals.

- Interpret and calculate VAT on real-world bills.

- Use calculators effectively for financial operations.

Engagement & Motivation

High — students immediately recognise how VAT affects real prices. The relevance to everyday life (electricity bills, shopping, services) fosters intrinsic motivation and financial confidence. Visual feedback strengthens satisfaction and mastery.

Error Opportunities & Misconceptions

- Confusing 1.15 with 0.15 (forgetting to include the full amount).

- Dividing instead of multiplying.

- Calculating only the VAT portion rather than the total with VAT included.

- Mistyping decimals on the calculator.

Each screen contrasts incorrect and correct operations to clarify the logic behind using 1 + VAT% as a multiplier.

Transferability / Real-World Anchoring

Very High — the ability to include VAT applies across daily financial contexts: shopping, utilities, taxes, and receipts. Students develop financial literacy and confidence interpreting percentage-based changes in cost.

Conceptual vs Procedural Balance

Balanced — learners gain procedural fluency in multiplying by decimals while developing conceptual understanding of percentage increase. The “1” in 1.15 retains the base amount; the “.15” adds the VAT proportion — a clear visual model of increase.

Learning Objectives Addressed

- Convert VAT percentages into decimal multipliers.

- Multiply totals by VAT-inclusive rates (e.g., 1.15, 1.21).

- Interpret financial tables and identify relevant quantities.

- Use calculators effectively to compute total cost with VAT.

- Explain conceptually why multiplying by a number >1 increases a value.

What Your Score Says About You

- Less than 5: You may still be unsure how VAT is added — remember, 1.15 means 115% of the original.

- 6–7: You understand VAT but need to practise accurate decimal entry and interpretation.

- 8–9: Strong understanding of percentage–decimal links — confident with VAT calculations.

- 10 / 10: Excellent! You can calculate VAT-inclusive totals accurately and explain why — a vital adult life skill.